Have you ever wondered if you can set up your own will? It’s a question that many of us have pondered at some point. After all, a will is an important legal document that ensures your wishes are carried out after you pass away. In this article, we will delve into the topic in detail and provide you with the necessary information to set up your own will. So, let’s get started!

Setting up your own will may seem like a daunting task, but it’s actually quite manageable with the right guidance. In the upcoming paragraphs, we’ll walk you through the steps involved in creating your will and highlight some key considerations along the way. From understanding the basic components of a will to choosing an executor to distribute your assets, you’ll gain a comprehensive understanding of the process. So, if you’re ready to take control of your future and ensure your loved ones are taken care of, stay tuned for the rest of the article. You’ll discover that setting up your own will is not as complicated as it may initially seem.

Table of Contents

How to Set Up Your Own Will

Setting up your own will is a crucial step in ensuring that your wishes are followed after you pass away. While the thought of drafting a legal document can be intimidating, the benefits of having control over your estate and the peace of mind it brings far outweigh any initial concerns. In this article, we will guide you through the process of setting up your own will, including the legal requirements, important components to include, steps to follow, and common mistakes to avoid. By the end, you will have the knowledge and confidence to take control of your legacy.

Benefits of Setting Up Your Own Will

Control and Autonomy

One of the primary benefits of setting up your own will is the control it gives you over the distribution of your assets. Without a will, your estate will be distributed according to the laws of intestate succession, which may not align with your desires. By setting up your own will, you can specify exactly how you want your assets to be divided among your beneficiaries, ensuring that your wishes are upheld.

Furthermore, having a will allows you to appoint an executor of your choice. This person will be responsible for managing your estate, ensuring that your assets are distributed according to your instructions, and handling any legal and financial matters. By selecting someone you trust, you can have peace of mind knowing that your affairs will be in capable hands.

Cost Savings

Another advantage of setting up your own will is the potential cost savings. While consulting with an attorney to draft your will may seem like the only option, it is not mandatory. Many individuals are perfectly capable of setting up their own wills without legal assistance, especially for simple estates. By taking the initiative to create your own will, you can avoid costly attorney fees and put those savings towards other aspects of your legacy planning.

Flexibility

When you set up your own will, you have the flexibility to customize it according to your specific circumstances. You can include provisions for unique assets, such as family heirlooms or business interests, and make special requests for their distribution. Additionally, you can establish trusts for minor beneficiaries or individuals with special needs, ensuring that your assets are protected and managed appropriately even after you are gone. This flexibility allows you to tailor your will to meet your individual needs and the needs of those you care about most.

Privacy

Privacy is another important benefit of setting up your own will. When a will goes through the probate process, it becomes a matter of public record. This means that anyone can access and review the details of your estate, including the distribution of your assets and the identities of your beneficiaries. By setting up your own will, you can opt for alternative methods of transfer, such as creating a living trust, which can help maintain the privacy and confidentiality of your estate planning decisions.

Understanding the Legal Requirements

Before diving into the process of setting up your own will, it is essential to familiarize yourself with the legal requirements that govern wills in your jurisdiction. While these requirements may vary, there are several key aspects to consider.

Research Your Local Laws

Start by researching the laws regarding wills in your specific jurisdiction. Each state, and sometimes even different countries, may have its own set of rules and regulations that dictate how wills should be prepared and executed. Understanding these laws will ensure that your will is valid and enforceable.

Determine the Eligibility

Certain individuals may be excluded from creating a will due to legal restrictions. For example, minors, individuals lacking mental capacity, or those convicted of certain crimes may be ineligible. Ensure that you meet the requirements to set up a will before proceeding.

Know the Age Requirements

Most jurisdictions require individuals to be of a certain age, typically 18 or older, in order to create a legally binding will. Make sure you meet the minimum age requirement set by your local laws before proceeding.

Consider Witnesses and Notarization

Many jurisdictions require wills to be witnessed and/or notarized to ensure their validity. Witnesses serve as evidence that the testator (the person creating the will) signed the document willingly and was of sound mind at the time. Notarization adds an extra layer of authenticity to the will. Familiarize yourself with the specific witness and notary requirements in your jurisdiction to ensure that your will meets all necessary legal formalities.

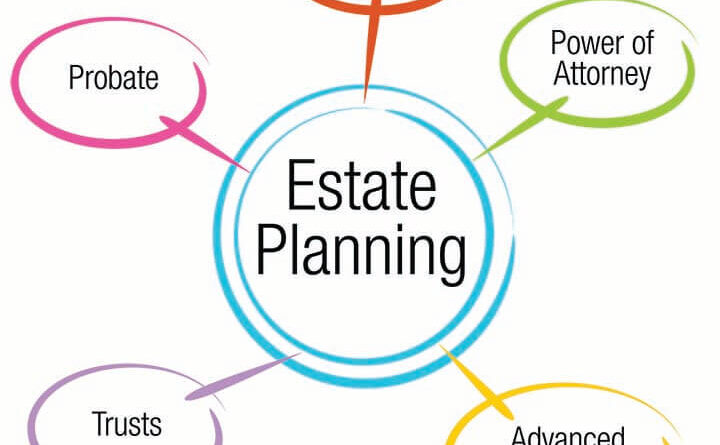

Important Components of a Will

When setting up your own will, it is crucial to include certain key components to ensure that all important aspects of your estate planning are covered. The following components should be carefully considered:

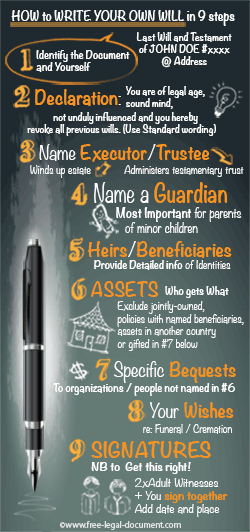

Executor Designation

Choosing an executor, also known as a personal representative, is an important decision in the will drafting process. Your executor will be responsible for carrying out your wishes, managing your estate, and handling any legal and financial matters. It is important to select someone you trust, who is capable, organized, and willing to take on this responsibility.

Beneficiary Designation

Clearly identify the individuals or organizations that will receive your assets upon your passing. These beneficiaries may include family members, friends, charities, or other entities. Clearly stating your intentions will help prevent confusion and disputes among your loved ones.

Asset Distribution

Specify how you want your assets to be distributed among your beneficiaries. This can include cash, real estate, investments, personal belongings, and any other assets you own. Be as specific as possible, and consider alternate beneficiaries in case your primary choices cannot inherit your assets.

Guardianship Provisions

If you have minor children, it is important to include guardianship provisions in your will. Designate a guardian who will take care of your children in the event of your passing. Make sure to discuss this responsibility with the chosen individual(s) beforehand and obtain their consent.

Funeral and Burial Instructions

While it may be a sensitive topic, including funeral and burial instructions in your will can provide guidance to your loved ones during an emotional time. Specify your preferences regarding burial or cremation, the type of funeral or memorial service you desire, and any other relevant details.

Steps to Set Up Your Own Will

Now that you understand the legal requirements and important components of a will, let’s walk through the steps involved in setting up your own will. By following these steps, you can ensure that your wishes are clearly articulated and legally binding:

Gather Necessary Documents

Before drafting your will, gather any necessary documents such as property deeds, investment statements, bank account information, and other relevant financial records. Having these documents on hand will help you accurately assess your assets and ensure that nothing important is overlooked.

Identify Your Assets

Make a comprehensive inventory of your assets, including bank accounts, investments, real estate, vehicles, valuable possessions, and personal belongings. Assign a value to each asset if possible. This information will be crucial when determining how you want your assets to be distributed among your beneficiaries.

Determine Beneficiary Designation

Review your assets and make decisions about who you want to inherit each asset. Consider the needs and circumstances of each potential beneficiary when making these decisions. It is important to be clear and specific to avoid any confusion or disputes in the future.

Appoint an Executor

Choose a trusted individual to serve as the executor of your will. Discuss your intentions with this person beforehand, and make sure they are willing to take on this responsibility. Consider appointing an alternate executor in case your primary choice is unable or unwilling to fulfill the role.

Include Specific Instructions

Be as specific as possible when outlining your wishes in your will. Provide instructions on how you want your assets to be distributed, any conditions or restrictions you want to impose, and any other relevant details. Clear and concise instructions will help minimize confusion and avoid potential conflicts among your loved ones.

Review and Update Regularly

Once your will is drafted, it’s important to review and update it regularly. Life events such as marriage, divorce, birth of children or grandchildren, and changes in financial circumstances may necessitate modifications to your will. Set a reminder to review your will periodically and seek professional advice if needed.

Understanding Intestate Succession

In the event that you pass away without a will, your estate will be subject to the laws of intestate succession. Understanding how this process works can highlight the importance of setting up your own will.

What Happens Without a Will?

When someone dies without a will, their assets are distributed according to a predetermined legal framework. This process may not align with your wishes and could result in unintended beneficiaries receiving your assets. By setting up your own will, you have the power to ensure that your assets are distributed according to your desires.

Laws of Intestate Succession

The laws of intestate succession vary depending on your jurisdiction, but they generally outline the distribution of assets among surviving family members. Spouses, children, parents, and siblings are typically the first in line to inherit, while more distant relatives may receive a portion if closer relatives are not present. Consulting local laws or seeking legal advice will provide clarity on how assets are allocated in intestate succession.

Distribution Among Family Members

Intestate succession laws allocate assets among family members based on specific rules. For example, if you have a surviving spouse and children, your assets may be divided between them in a predetermined manner. If you have no surviving spouse or children, the distribution may extend to other relatives. Keep in mind that these laws may not align with your wishes, emphasizing the importance of setting up your own will.

Seeking Legal Advice and Assistance

While setting up your own will is entirely possible, there may be situations where seeking legal advice or assistance is recommended.

When to Consult an Attorney

If your estate is complex, involves significant assets, or involves unique circumstances, it may be wise to consult with an attorney who specializes in estate planning. They can provide guidance and ensure that your will is legally valid, covering all important aspects of your estate planning. Additionally, an attorney can help navigate any specific legal requirements or complexities that may arise.

Finding a Competent Estate Planning Lawyer

When seeking legal advice, it is important to find a competent estate planning lawyer who specializes in wills and trusts. Look for recommendations from friends, family, or other professionals. Research potential lawyers, read reviews, and consider scheduling initial consultations to assess their expertise and compatibility with your needs.

Considering Online Will Services

An alternative to consulting an attorney is to use online will services. These services typically provide customizable templates and guides to help you draft your own will. While these services can be cost-effective and convenient, it is important to choose a reputable and trustworthy provider. Evaluate the security of their platform and read reviews and testimonials from previous users before proceeding.

Common Mistakes to Avoid

When setting up your own will, it is crucial to avoid common mistakes that can render your wishes ineffective or cause unnecessary complications for your beneficiaries. Beware of the following pitfalls:

Ignoring Legal Formalities

Ensure that your will complies with all necessary legal formalities, including witnessing and notarization requirements. Failing to meet these requirements can result in your will being deemed invalid or challenged in court.

Not Updating following Life Events

Life events such as marriage, divorce, the birth of children or grandchildren, or changes in financial circumstances can significantly impact your estate planning. Failing to update your will accordingly may lead to unintended consequences or beneficiaries being left out.

Ambiguity and Incomplete Instructions

Be clear and specific when outlining your wishes in your will. Ambiguity or incomplete instructions can lead to confusion and disagreements among your loved ones. Take the time to provide detailed instructions to minimize any potential disputes.

Improper Execution

Make sure you sign and date your will in the presence of witnesses, if required by your jurisdiction. Incorrectly executing your will can render it invalid and negate all your efforts. Follow all necessary execution procedures to ensure your will is legally binding.

Communication and Notification

Once your will is established, it is important to inform your loved ones and executor to ensure a smooth transition after your passing. Additionally, take measures to store your will safely and provide copies to relevant parties.

Informing Loved Ones and Executor

Communicate your intentions and the existence of your will to your loved ones and appointed executor. Discuss your wishes openly, highlight the location of your will, and provide any necessary instructions. This will help avoid confusion and ensure that your beneficiaries are aware of their roles and responsibilities.

Storing Your Will Safely

Store your will in a safe and secure location, such as a locked filing cabinet or a safety deposit box. Inform your executor and trusted family members or friends about the location of your will to ensure that it can be accessed easily when needed.

Providing Copies to Relevant Parties

Consider providing copies of your will to your executor, trusted family members, or individuals whose involvement is crucial to the execution of your estate plan. This will help ensure that your wishes are carried out effectively and minimize any potential complications.

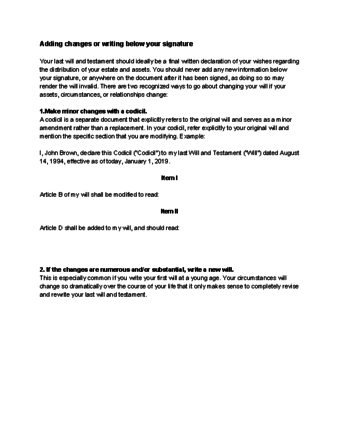

Reviewing and Modifying Your Will

Your will is a living document that should be reviewed and updated regularly to reflect any changes in your personal or financial circumstances. Certain life events may trigger the need for modifications or amendments to your will.

Reasons for Reviewing Regularly

Regularly reviewing your will ensures that it remains up to date and relevant. Changes in your assets, relationships, or personal circumstances may necessitate modifications to ensure that your will accurately reflects your wishes.

Life Events That May Trigger Changes

Marriage, divorce, births, deaths, and significant changes in financial circumstances or assets are common events that may trigger the need for updates to your will. Consider reviewing and, if necessary, modifying your will to accommodate these changes.

Seeking Professional Advice for Modifications

If you are unsure about how changes in your circumstances may impact your estate plan, consider seeking professional advice from an attorney or estate planning expert. They can guide you through the modification process and ensure that your changes are properly executed.

Conclusion

Setting up your own will is an important step in taking control of your legacy and providing peace of mind for yourself and your loved ones. By understanding the legal requirements, including important components, following the necessary steps, and seeking appropriate advice when needed, you can ensure that your wishes are fulfilled and your assets are distributed according to your desires. By proactively managing your estate planning, you can leave behind a lasting legacy that reflects your values and provides for those you care about most.